15-Yr vs. 30-Yr Mortgages: Which is Higher?

When you resolve to change into a house owner, it’s doubtless that you will want to take out a mortgage to buy your new house. Whereas the conclusion that you just want a mortgage to finance your own home is normally simple to reach at, deciding which one is best for you could be overwhelming. One of many many choices a potential homebuyer should make is selecting between a 15-year versus 30-year mortgage.

From the names alone, it’s laborious to inform which one is the higher possibility. Beneath best circumstances, a 15-year mortgage mathematically is sensible as the higher possibility. Nonetheless, the trail to homeownership is usually removed from best (and who’re we kidding, beneath best circumstances we’d all have massive sums of cash to buy a home in money). So the higher query for homebuyers to ask is which one is finest for you?

That will help you take advantage of knowledgeable monetary selections, we element the variations between the 15-year and 30-year mortgage, the professionals and cons of every, and choices for which one is best primarily based in your monetary priorities.

The Distinction Between 15-Yr Vs. 30-Yr Mortgages

The primary distinction between a 15-year and 30-year mortgage is the period of time through which you promise to repay your mortgage, also referred to as the mortgage time period.

The mortgage time period of a mortgage has the power to have an effect on different facets of your mortgage like rates of interest and month-to-month funds. Mortgage phrases are available in a wide range of lengths akin to 10, 15, 20, and 30 years, however we’re discussing the 2 commonest choices right here.

What Is a 15-Yr Mortgage?

A 15-year mortgage is a mortgage that’s meant to be paid in 15 years. This shorter mortgage time period implies that amortization, in any other case referred to as the gradual reimbursement of your mortgage, occurs extra shortly than different mortgage phrases.

What Is a 30-Yr Mortgage?

However, a 30-year mortgage is repaid in 30 years. This longer mortgage time period implies that amortization occurs extra slowly.

Professionals and Cons of a 15-Yr Mortgage

The shorter mortgage time period of a 15-year mortgage means extra money saved over time, however sacrifices affordability with greater month-to-month funds.

Professionals

Decrease rates of interest (usually by a full share level!)

Much less cash paid in curiosity over time

Cons

Larger month-to-month funds

Much less affordability and adaptability

Professionals and Cons of a 30-Yr Mortgage

Because the mortgage time period chosen by the vast majority of American homebuyers, the longer 30-year mortgage time period has the benefit of inexpensive month-to-month funds, however comes at the price of extra money paid over time in curiosity.

Professionals

Decrease month-to-month funds

Extra inexpensive and versatile

Cons

Larger rates of interest

Extra money paid in curiosity over time

15-Yr Mortgage

30-Yr Mortgage

Professionals

• Decrease rates of interest

• Much less cash paid in curiosity over time

• Decrease month-to-month funds

• Extra inexpensive and versatile

Cons

• Larger month-to-month funds

• Much less affordability and adaptability

• Larger rates of interest

• Extra money paid in curiosity over time

Which Is Higher For You?

Now with what concerning the execs and cons of every mortgage time period, use that data to match your monetary priorities with the mortgage that’s finest for you.

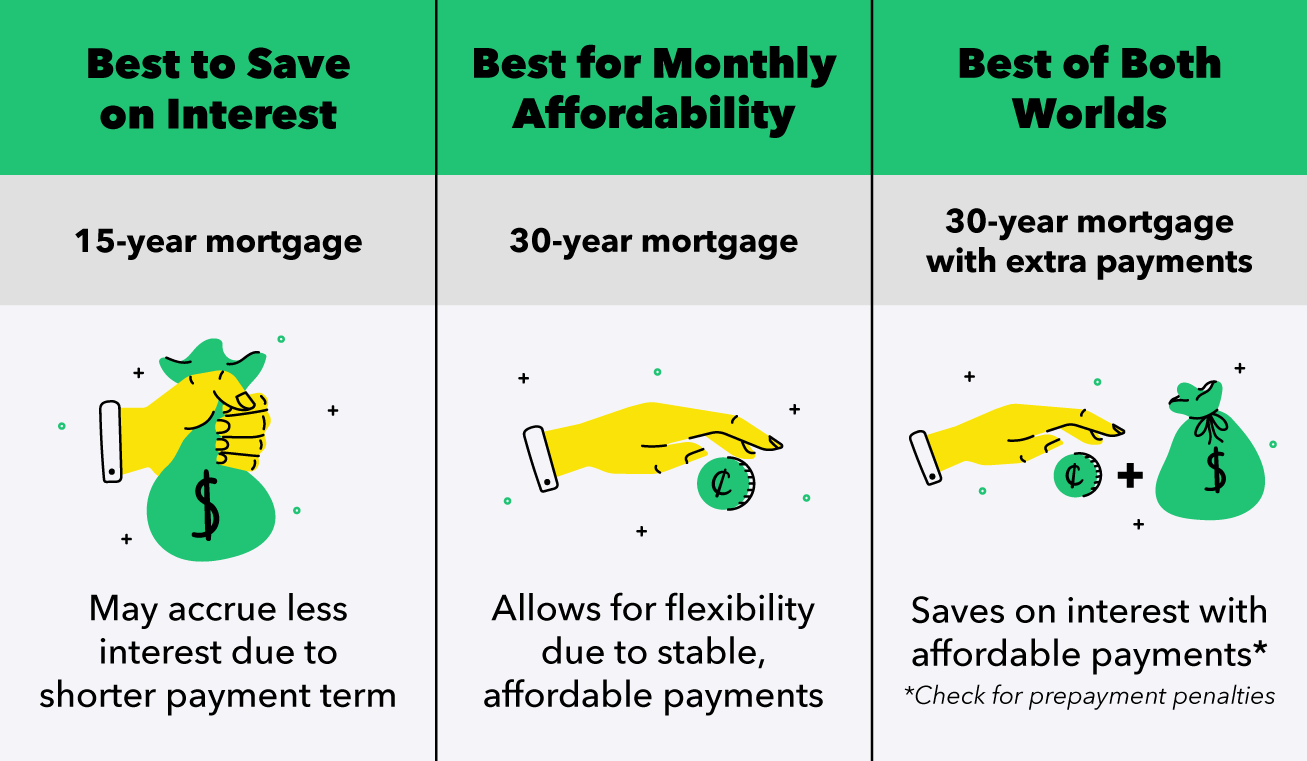

Greatest to Save Cash Over Time: 15-Yr Mortgage

The 15-year mortgage could also be finest for many who want to spend much less on curiosity, have a beneficiant earnings, and now have a dependable quantity in financial savings. With a 15-year mortgage, your earnings would should be sufficient to cowl greater month-to-month mortgage funds amongst different dwelling bills, and ample financial savings are essential to function a buffer in case of emergency.

Greatest for Month-to-month Affordability: 30-Yr Mortgage

A 30-year mortgage could also be finest in case you’re in search of secure and inexpensive month-to-month funds or want for extra flexibility in saving and spending your cash over time. The longer mortgage time period may be the higher possibility in case you plan on buying property you couldn’t usually afford to repay in simply 15 years.

Better of Each: 30-Yr Mortgage with Additional Funds

Need the perfect of each worlds? A very good possibility to avoid wasting on curiosity and have inexpensive month-to-month funds is to go for a 30-year mortgage however make further funds. You possibly can nonetheless have the objective of paying off your mortgage in 15 or 20 years time on a 30-year mortgage, however this feature could be extra forgiving if life occurs and also you don’t meet that objective. Earlier than going this route, be certain that to ask your lender about any prepayment penalties which will make curiosity financial savings from early funds out of date.

As a potential homebuyer, it’s essential that you just set your self up for monetary success. Positive-tuning your private finances and diligently saving and paying off debt assist put together you to take the subsequent steps towards shopping for a brand new house. Doing all your analysis and studying about mortgages additionally helps you make selections in your finest curiosity.

When choosing a mortgage, all the time have in mind what’s financially life like for you. If which means forgoing higher financial savings on curiosity within the title of affordability, then do not forget that path nonetheless results in homeownership. Check out these finances templates in your house or month-to-month bills to assist hold you on an excellent path to attaining your targets.

Sources: Shopper Monetary Safety Bureau

Join Mint right now

From budgets and payments to free credit score rating and extra, you’ll

uncover the easy approach to keep on prime of all of it.

Study extra about safety